The phenomenal success of anti-PD-1 (programmed death-1) drugs for the treatment of cancer started in 2014 with the approvals of the monoclonal antibodies pembrolizumab (Keytruda) and nivolumab (Opdivo). These immuno-oncology (IO) drugs are now approved for use across multiple cancer types, and the mechanism through which they work has been recognized as a powerful strategy in cancer immunotherapy. A key step in developing these agents is to comprehensively characterize their functionality by demonstrating their ability to enhance T cell mediated killing and cytokine production.

In this post we explore the different in vitro potency assays for assessing the function of anti-PD-1 checkpoint inhibitors on T cell responses in mono or combinational treatment.

Anti-PD-1 Mechanism of Action

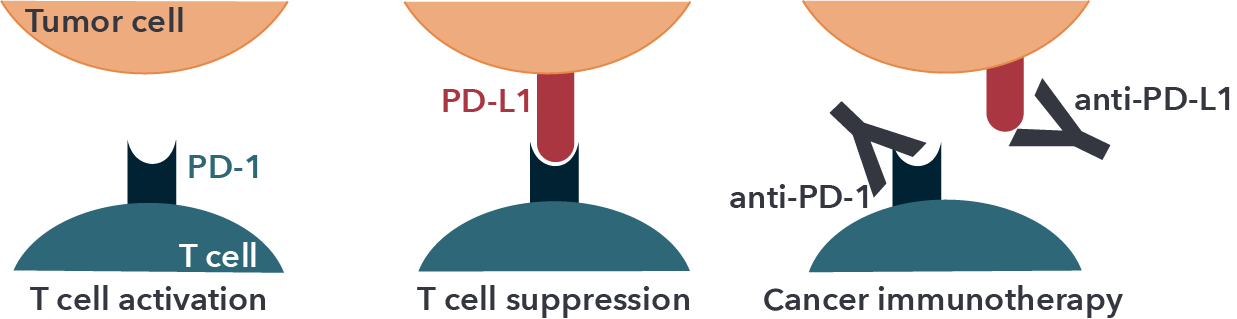

As depicted in the illustration below, anti-PD-1 drugs work by activating T cells. They do this by blocking the cell surface receptor “PD-1” (also known as CD279), which is expressed on activated T cells and is a major negative regulator of T cell activation.

Figure 1: Schematic of the molecular mechanism of checkpoint blockade by therapeutic antibodies for cancer immunotherapy. T cell activation is suppressed by the interaction between PD-1 on T cells and PD-L1 on tumor cells. Antibody drugs for cancer immunotherapy bind to PD-1 or PD-L1, blocking the PD-1/PD-L1 interaction.

Adapted from Lee et. al. (2019). Molecular Interactions of Antibody Drugs Targeting PD-1, PD-L1, and CTLA-4 in Immuno-Oncology. Molecules. 24, 1190; doi:10.3390/molecules24061190. Used under Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

PD-1 interacts with its related programmed cell death-ligands, PD-L1 and PD-L2, expressed on antigen presenting cells (APCs) such as dendritic cells (DCs). Cancer cells often exploit this immune resistance mechanism of the PD-1/PD-L1 pathway to their advantage and escape from the immunological surveillance of T cells. In this context, PD-L1 has been found to be overexpressed on the surface of different cancer types, including breast cancer, lung cancer, bladder cancer, lymphoma, glioblastoma and melanoma. Thus, in the tumor microenvironment (TME), the over-expressed PD-L1 binds to PD-1 and suppresses the T cell-mediated anti-tumor immune responses, thereby supporting survival and expansion of tumor cells.

In Vitro Assays for Supporting Anti-PD-1 Development

The development of anti-PD-1 drugs in both mono and combinational treatment requires demonstrating their functionality as opposed to using surrogate measurements. A variety of validated functional assays have been developed to support their in vitro characterization, such as comparing differences across clones or potency against approved reference products (e.g., pembrolizumab and nivolumab). This section provides a summary of these assays, some of which were presented at AACR 2024.

T Cell-mediated Tumor Killing Assays

Co-culture of tumor cells with either autologous or non-autologous immune cells are invaluable for monitoring immune-mediated tumor killing, with common readouts being high content imaging (HCI), LDH release, flow cytometry, real-time imaging and cytokine release assays. While autologous systems are ideal, there are some well-recognized challenges associated with this approach, including;

- limited volume of blood from donor cancer patients,

- lack of tumor-reactive T cells among PBMC from most donor patients,

- limited scalability for drug development applications.

On the other hand, non-autologous PBMCs enable higher throughput and multi-model screening, while a recognized limitation is that they are more challenging to test antigen specificity observed in the clinical setting.

Simple co-cultures to access the PD-1/PD-L1 blockade can be generated with tumor cells expressing PD-L1 at baseline level, upon cytokine stimulation or overexpressed upon engineering together with allogenic immune cells expressing PD-1. Within these co-cultures binding of PD-L1 to PD-1 can occur and subsequently lead to the inhibition of TCR signaling in the effector cells. Analysis of this binding and comparing it to reference products such as pembrolizumab and nivolumab is feasible with different readouts.

For example, effector cells that express a luciferase reporter downstream of an NFAT-response element (RE) will prevent luciferase expression in the absence of TCR signaling. Then in the presence of a PD-1/PD-L1 inhibitor, a bioluminescent signal is generated which can be detected and quantified. Serial dilutions of the inhibitor allow for the evaluation of potency, while assessing stability can be done by maintaining the agent at different temperatures and/or treating for different lengths of time.

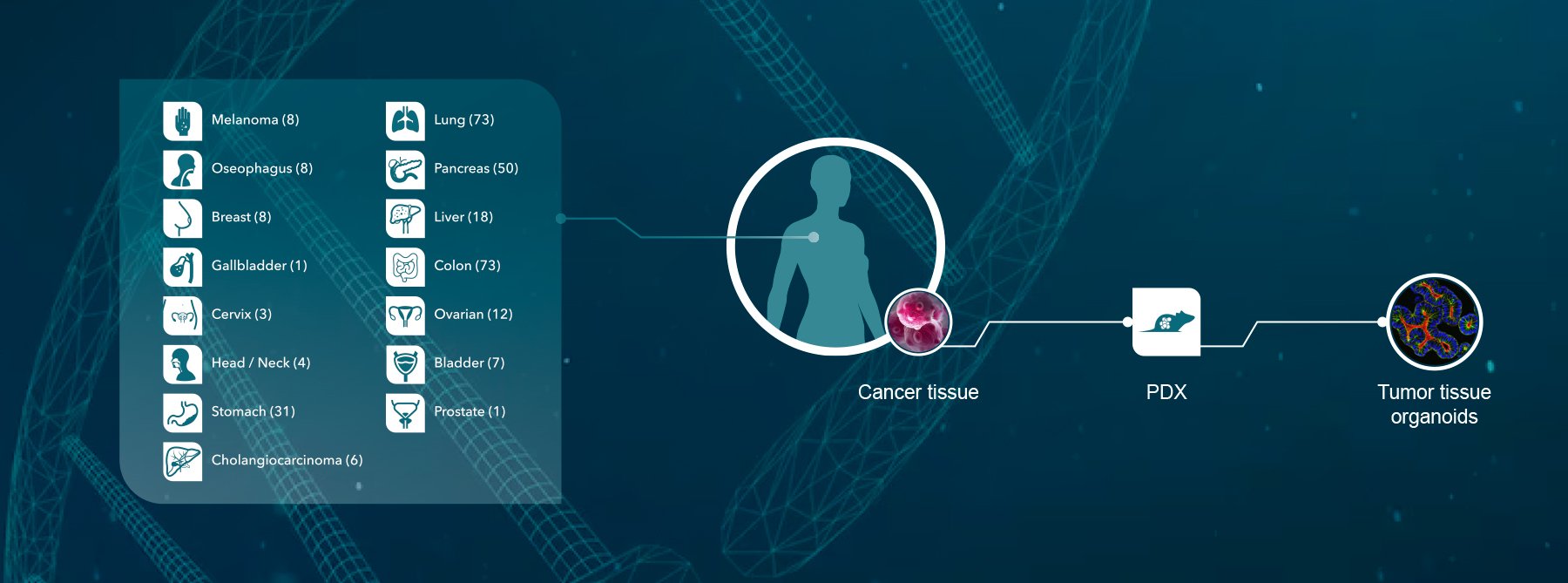

To enhance the clinical relevance of co-culture assays, cancer patient-derived organoids (PDO) are increasingly being used. Tumor organoids are advanced 3D culture models that have revolutionized the field of oncology research. They preserve many of the genomic, morphological and physiology features of the original patient tumor, and they have been shown to offer superior clinical relevance, patient diversity and predictivity of drug response in comparison to conventional 2D cell cultures. They are also highly scalable, provide a nearly unlimited source of patient material and have capacity for co-culture with autologous or non-autologous immune cells.

Additionally, an image-based analysis of these co-cultures will maintain the relevant spatial information of both tumor and immune cells and could be performed with HCI or live imaging with for example xCELLigence or Incucyte instruments. These methods also allow more in-depth analysis of morphological features to better understand the mode of action (MoA). A co-culture system involving luciferase labelled tumor organoids to measure the effect of PD-1 blockade on tumor organoid killing mediated by T cells could be used as an alternative.

Ex Vivo Patient Tissue

Alternatively, 3D ex vivo microtumors derived from fresh patient material can be used to predict the response to immune checkpoint inhibitors. These tissues preserve the native TME which can contain crucial components, such as fibroblasts and endogenous immune cells, to measure drug responses. By maintaining the complexity of the tumor and potentially adding autologous immune cells an in vitro assay with patient relevant translational systems can be used. Specifically, these materials have demonstrated a similar sensitivity towards immune checkpoint treatment as found in patients in the clinic thereby making this material very interesting to predict clinical outcome.

Different methodologies can be used to analyze ex vivo patient tissues. Functional analysis of 3D cultures upon drug treatment can be executed via HCI, while more insights in the immune cell compartment can be obtained via biomarker analysis with FACS or IHC. Working with fresh patient material is however limited to the amount of material collected and therefore the experimental design and usage of the tissue is very important.

In Vitro Assays in Reconstituted vs Native TME

Figure 2: Schematic overview of in vitro based assays that either reconstitute the TME by including

several cellular players or work with the native TME by using fresh patient material.

Allogeneic Mixed Lymphocyte Reaction (MLR) Assay

The allogeneic MLR assay is also a co-culture assay and permits measurement of DC-mediated T cell activation. The responder (e.g., CD4+ T cells) and stimulator cells (e.g., monocyte-derived DCs or peripheral blood mononuclear cells [PBMCs]) must come from different donors since T cell activation is based on an allogeneic immune reaction.

Allogenic MLRs can be used in conjunction with live imaging, flow cytometry, ELISA, or other microplate-based readouts to measure cytokine production or cell proliferation.

Figure 3: Schematic overview of MLR co-cultures with effector T cells coming from one donor mixed with DCs from another donor.

Stimulation of Immune Cells

In this assay, T cell activation is measured using assays that involve exposure to specific antigens such as Staphylococcal enterotoxin aureus (SEA). SEA is a bacterial toxin that has the capacity to bind MHC class II molecules on antigen-presenting cells (APCs) and the TCR to induce the release of pro-inflammatory cytokines such as IL-2, IL-6, TNF-α and IFN-γ.

PBMCs or whole blood can be used for antigen stimulation followed by ELISA or flow cytometry for cytokine release quantification. Flow cytometry-based cytometric bead arrays can be used for detecting multiple cytokines simultaneously and pre-labelling samples with CFSE or similar dyes can be used to measure T cell proliferation. A reliable method to monitor for T cell responses includes cytokine and chemokine profiling through Luminex® and MSD S600 alongside conventional single-plex ELISA.

Antigen-Specific T Cell Recall and Activation Assay

In addition to enhancing T cell activation and proliferation, blockade of the PD-1 axis has also been shown to induce the formation of memory T cells which contributes to their anti-tumor activity. This phenomenon can be monitored in vitro using an antigen recall and activation assay. Briefly, fresh PBMCs are obtained from individuals with prior exposure to a viral or bacterial antigen and memory T cell expansion is measured following re-exposure to the antigen.

Cytomegalovirus (CMV) based recall and activation assays are commonly used. In this type of assay, PBMCs from CMV seropositive patients are isolated and stimulated with CMV pp65 protein pool (i.e., a mixture of peptides from the 65kDa phosphoprotein [pp65] of human CMV) for multiple days in the presence or absence of anti-PD-1 agents.

A CMVpp65-tetramer is then used to capture CMVpp65-specific CD8+ T cells for flow cytometry to evaluate whether an expansion of this subset occurred in response to PD-1 inhibition. Other available recall assays use toxins (e.g., tetanus toxin) or other viral antigens (e.g., Epstein–Barr virus, influenza), either individually or in a pooled format.

Treg-mediated T Cell Suppression Assay

The success of immune checkpoint inhibitors highlights the importance of maintaining a balance between T cell activation and inhibition for tumor cell elimination. At the cellular level, regulatory T cells (Tregs) help to balance the immune response by suppressing effector T cell functions. The ratio of effector T cells and Tregs within the TME has been shown to be an important predictor of patient outcomes and response to checkpoint inhibitor therapy.

PD-1 is expressed on a subset of Tregs, however PD-1 blockade can abolish their suppressive effects or potentially lead to expansion of Tregs and disease progression. Given the complex biology surrounding PD-1 and Tregs, assays that monitor Treg function may help shed light the impact of novel anti-PD-1 molecules on Treg function.

A basic Treg suppression assay setup involves the co-culture of two different cell populations (Tregs and responder cells such as CD4+ T cells). T cell activation can be induced using anti-CD3/anti-CD28 beads followed by treatment with test or reference compounds. A variety of suppression readouts can then be used including proliferation assays (CFSE, [H3] thymdine incorporation) or marker analysis by flow cytometry.

Conclusion

Immune checkpoint inhibitors have transformed the cancer treatment landscape. Drug developers are advancing with new checkpoint inhibitors and evaluating the potential of combination treatments with standard of care treatment and additional immune modulators. This had led to a rise in demand for in vitro assays that enable the functional characterization of these new drugs in mono or combination treatment. As summarized in this post, there are a variety of in vitro potency assays for assessing the function of anti-PD-1 checkpoint inhibitors.

Following in vitro characterization, in vivo models are then required to advance the development of your most promising candidates. Validated humanized in vivo immuno-oncology models are available to address a wide range of questions, including CD34+ and PBMC-humanized mice as well as HuGEMM™ models that feature the expression of human targets for immuno-oncology applications.

Learn more about how Crown Bioscience can help in the development of your anti-PD-1 biosimilar and Humanized Target Project.